Benny Cheung on the Brainy Business podcast

Insurance Fraud Prevention

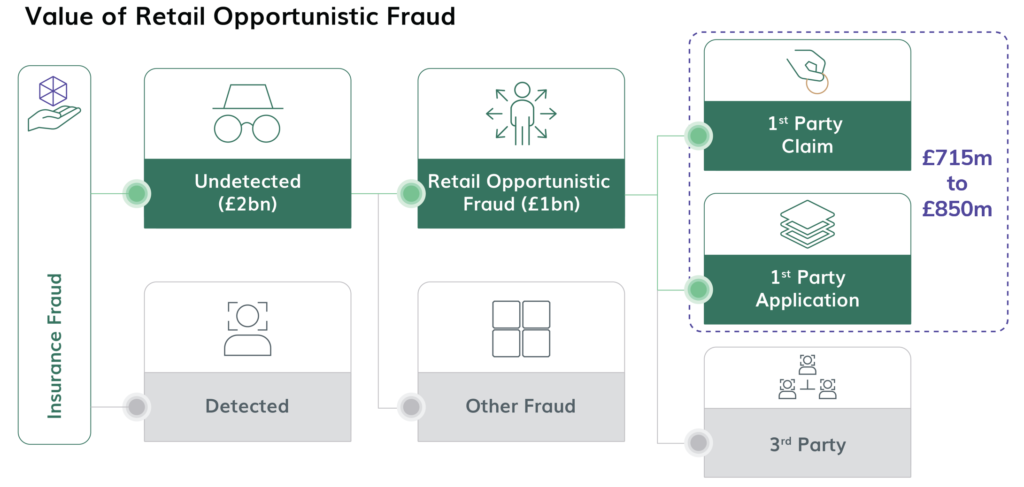

Retail opportunistic insurance fraud is hard to detect and costs the industry £1bn per year. Our ground-breaking research showed that by applying behavioural ‘nudges’ in the customer journey, we could reduce fraud by up to 70%, without the risk of alienating customers.

Watch our video and read the case study below to find out how we use behavioural ‘nudges’ to reduce retail opportunistic insurance fraud

Situation

Retail opportunistic insurance fraud occurs when otherwise law-abiding citizens are dishonest or exaggerate when making insurance applications or claims in order to get a lower premium or higher claim. Separate from organised crime, it remains a significant problem for the industry. Individual incidents of retail opportunistic fraud are difficult to detect and are typically of low value, but occur at a high frequency. As such, it is estimated that it accounts for around half of all undetected fraud and could cost the industry as much as £1bn per year (of which up to £715m to £850m 1st party fraud). It is these characteristics of being low value, high volume, and committed in an ‘opportunistic’ manner that make this area of fraud hard to detect, costly to enforce penalties and therefore most effectively tackled through prevention.

Problem

The ABI Fraud Research Report estimates that the majority (almost 85%) of retail opportunistic fraud occurs in 1st party transactions. This offers insurers valuable opportunities to use the touch-points that already exist in their customer communication channels (e.g. applications, renewals and claims) for timely interventions to encourage honest behaviours and potentially save £850m per year. Historically, there has been some reluctance amongst insurers to over-play counter fraud during the customer journey, not least for fear of alienating customers. The Insurance Fraud Bureau (IFB), representing the UK insurance industry in the fight against insurance fraud, asked us to find novel approaches to sway fraudulent behaviours, change attitudes and deliver savings to both customers and insurers.

Approach

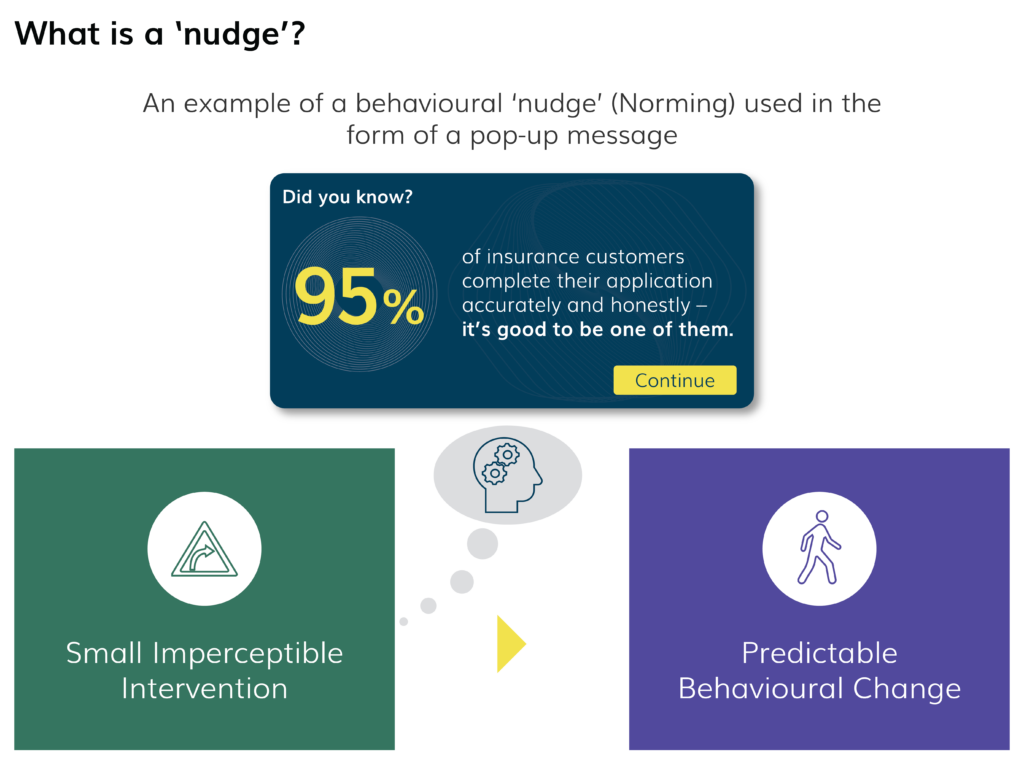

Applying our behavioural expertise, and following a review of existing research, we converged on a number of psychological principles (Norming, Self-consistency, Priming, Framing, and Reciprocation) that could be used to generate subtle ‘nudges’ that influence behaviour. In this instance, nudges took the form of pop-up messages that could be inserted into insurers’ online application and claims forms.

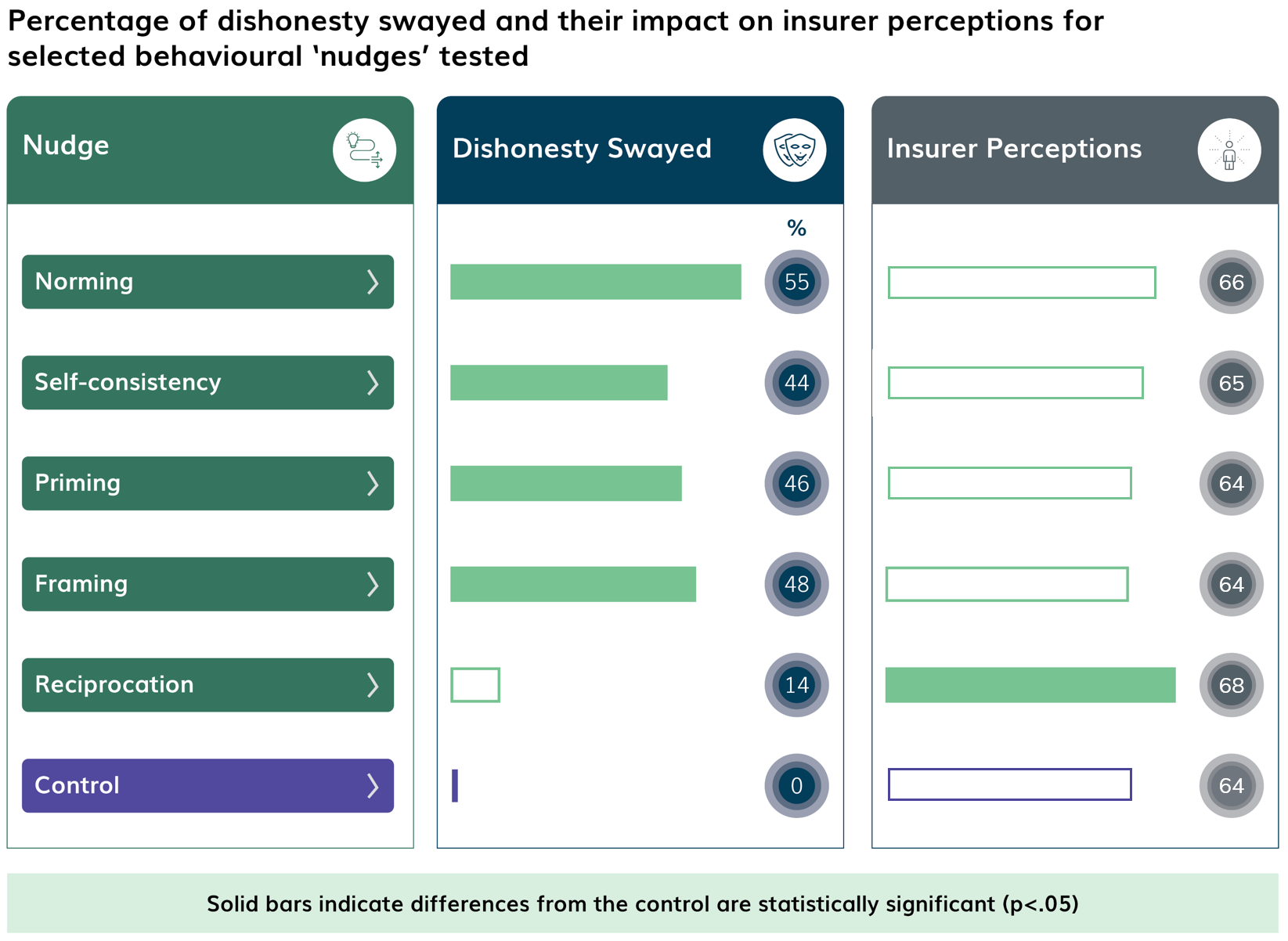

Using our Behaviourlab (based on Randomised Control Trial), we simulated realistic online motor insurance applications and claims scenarios to test the impact of these ‘nudges’ on over 12,000 real-life policy holders. Using scientific tools such as Unmatched Count Technique, the honesty of the participants was measured and effect of the ‘nudges’ on other key metrics (e.g. customer perceptions) were elucidated.

Want to find out more about how we crafted the behavioural ‘nudges’ and designed the experiment paradigm? Please see this page.

Impact

Almost all of the ‘nudges’ had a positive effect in swaying dishonesty, with an average effect size of 36%. Crucially, these results occurred without any negative impact on perceptions of the insurer or the process of completing the form (typically scoring 65-70 on a 0-100 perception rating scale).

Furthermore, in a follow-up study we demonstrated that applying more than one ‘nudge’ had an additive impact (up to 70% of dishonesty), without harming insurer perceptions.

We have previously estimated the cost of retail opportunistic fraud to be between £715m and £850m per year in the UK. This proof-of-concept work therefore indicates a potential saving to the insurance industry in the UK in the range of £132m and £395m per year (see this article for details).

Backed by this ground-breaking research, we are actively engaging with the industry to guide insurers through the process of implementing and trialling these ‘nudges’ in their own businesses, tailoring them to their unique situation. We are working with insurers to audit their systems, recommend the correct interventions to use, where and how, and working with them to pilot their application.

Subscribe to receive our latest insights and news on insurance fraud prevention

Tackling Opportunistic Insurance Fraud Animation

Dectech win MRS Award for Financial Services Research 2020

Benny Cheung in a Podcast with Human Risk

Dectech is the finalist in the Outsourced Partner of the Year category for the British Claims Awards 2020

Dectech Director Benny Cheung speaks at the Behavioural Science Summit 2020